Staking

Two types of Staking features are available: NFT Lending Pool and EPL Token Staking Program.

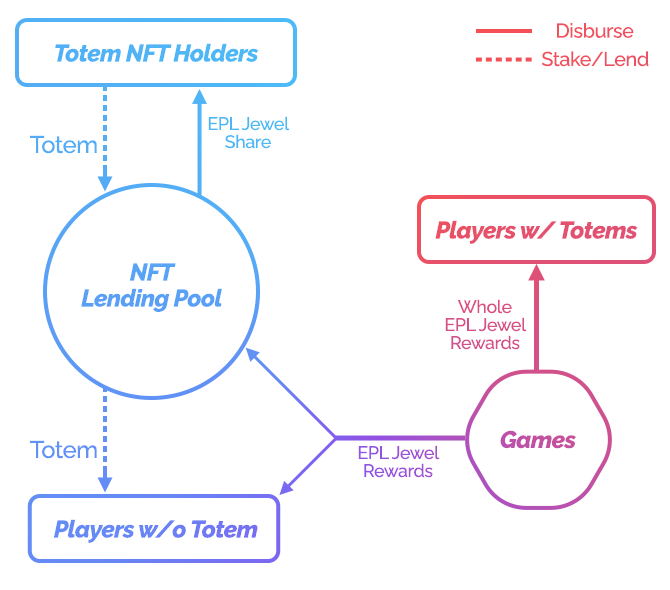

NFT Lending Pool is for both those who have redundant Totem NFTs and those who lack Totem NFTs. NFT Lending Pool allows players to easily borrow random Totem NFTs and to share EPL Jewel rewards with stakers of the lending pool.

Token Staking Program is planned and provided for benefits of participants and tightening EPL token market circulation. Also it allows active individuals who want to positively influence the ecosystem to participate in governance.

NFT Lending Pool

Users who currently possess redundant Totem NFTs can stake them. The staked Totem NFTs are automatically lent to players without totems, who then split EPL Jewel rewards via the lending pool and not directly with the totem holders. And on a daily basis, the accumulated EPL Jewels are distributed fairly to users who have staked Totem NFTs.

Token Staking Program

Users can use Token Staking Programs for their own benefits. Benefit programs are designed in various directions. Taking part in governance acts is one of the most common objectives of token staking. Staking programs generally encourage methods that prevent the circulation flooding of tokens.

However, they are unnecessary so long as deflation is sufficiently dominant. Nevertheless, appropriate levels of inflation or deflation are not easily regulated due to the interdependence of many participants’ psychology in the ecosystem. Some reasonable staking programs would contribute to the stability of the ecosystem. Benefits of token staking include ecosystem revenue share, in-game advantages, optional rewards, and other privileges.

More details are explained in Tokenomics.

Last updated